Liquidity has been operating in limited source in a pivotal corner of U.S. housing finance, as Wall Road braces for the Federal Reserve to substantially tighten economic disorders.

Several investment decision banking institutions now hope the Fed to increase its policy costs by 75 foundation points on Wednesday, relatively than the 50-foundation-stage raise telegraphed in advance of May’s buyer-price index confirmed U.S. inflation has still to ease from a 40-yr high.

Read through: A 75-foundation-position hike? In this article are 3 techniques the Fed can seem additional hawkish this week

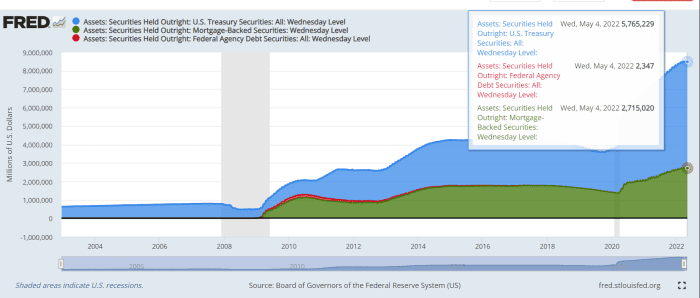

Incorporating to industry pressures, the Fed in June also commenced shrinking its in the vicinity of $9 trillion harmony sheet, a key spigot of liquidity, by beginning to minimize its report holdings (see chart) of Treasurys and company home loan-backed securities.

Federal Reserve seems to slash its approximately $2.7 trillion housing bond footprint

Board of Governors of the Federal Reserve Procedure

The trouble is that the large $8.4 trillion company house loan-backed securities (MBS) industry has started showing signs of anxiety, even ahead of the Fed starts to shrink, in earnest, its close to 32% stake in the governing administration-backed housing bond current market.

“It’s a whole lot of advertising, individuals increasing hard cash,” says Scott Buchta, head of a preset-earnings tactic at Brean Money, by phone. “There have been three or 4 days of continual advertising, ahead of the Fed decision.”

Even though marketplace conditions haven’t gotten almost as dire as in March 2020, right before the Fed rolled out its bazooka of pandemic help, Buchta reported turbulence in the property finance loan current market could intensify this summer months, except other purchasers phase in to fill the void remaining by the Fed.

Person buyers typically have publicity to the agency property finance loan bond marketplace via their fastened earnings holdings, but also from exchange-traded funds. The about $20.4 billion iShares MBS ETF

MBB,

was off 12.1% on the calendar year via Tuesday, when the near $12.5 billion

VMBS,

drop 12.5%, according to FactSet.

Couple corners of fiscal marketplaces have been immune to losses this yr, with the S&P 500 index

SPX,

down 21.6% so much, and officially in a bear market as of Monday.

When company home loan bonds often serve as a haven enjoy, or Treasury

TMUBMUSD10Y,

bond surrogate, “primary” broker sellers at major financial investment banking institutions have decreased their holdings by about 12% from a yr back, in accordance to a Deutsche Bank investigate report on Tuesday, very likely adding to liquidity woes.

“The Fed has owned these kinds of a important part of the MBS current market for so very long,” said Mark Fontanilla, founder of house loan analytics firm Mark Fontanilla & Co. “Now, if they want to suppress that, it’s a good deal of paper for the marketplace to take in, not only from discontinued obtaining, but in addition from just about anything they would market.”

In addition, the Fed’s retreat coincides with a tougher backdrop for the housing industry. Dwelling prices climbed about 20% in the earlier yr, but the 30-year fixed house loan charge has almost doubled to around 5.2%.

“That’s a roughly 30% better home loan payment in alone,” Fontanilla claimed. “Not only do you have to have a larger sized down payment, but a 30% larger home finance loan payment undoubtedly puts a dent in affordability.”

Also, as desire premiums climb, the value of leverage rises, a aspect Buchta explained will make it a lot more high-priced for potential buyers to phase in and finance trades in the sector.