Melena-Nsk/iStock by using Getty Photographs

Printed on the Value Lab 23/6/22

We are not Interfor (OTCPK:IFSPF) traders, but we have been following the organization for some months now and discover the commodity interesting as it connects to housing dynamics. Even though stop markets are uncovered to amount hikes, there are mitigating variables that can shield Interfor and continue to keep it over breakeven. Furthermore, tightness in logistics markets could turn into settled as costs rise and permit Interfor much more volumes and turnover, which has been a person of the factors for the slowdown prior to climbing rates. Whilst there is housing publicity, we believe that it just isn’t this sort of a threat area, and there are mitigating aspects that could soften a landing for lumber, like results from the Ukraine invasion. General, it is an appealing speculative idea.

Brief Reminder of Interfor Marketplaces

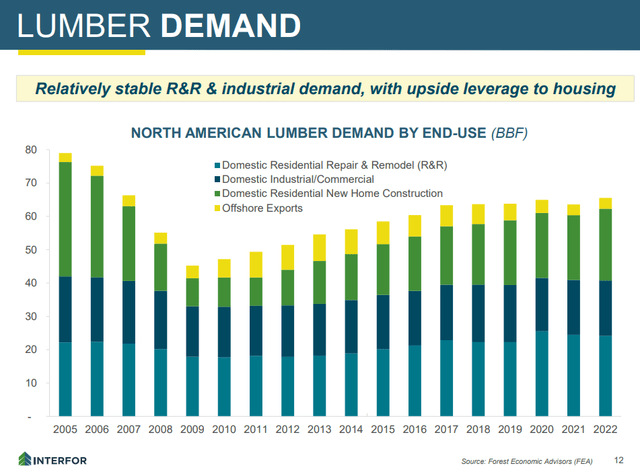

Interfor makes mostly everyday softwood lumber for use in Do it yourself and also housing and development. Do it yourself is the major marketplace, exactly where anything like OSB would be extra levered to housing starts off.

Segments (Q1 2022 Pres)

The housing channel has been steady these previous few of decades, like more than the COVID-19 time period wherever climbing authentic estate price ranges ongoing but provide chain challenges and lumber shortages intended that pent-up demand couldn’t be worked through at that moment. The Diy channel observed its spike in 2020 when all people was in lockdown, and it is retreating pretty much back again to normalised amounts.

Some Positives

It can be valuable to understand on an incremental basis what contributes to the Interfor investment circumstance:

- Exports are a really small contributor in terms of volumes, but the invasion of Ukraine and the consequent reticence or incapability to receive substantial timber and lumber provide from Ukraine and Russia indicates that Europe will have to resort to the US for imports. Whilst this is unlikely to cause monumental shifts in the export share, it is a nice minimal factor that must add to all round lumber volume progress.

- Do it yourself initiatives commonly claim share of family budgets, albeit contracted kinds, through a recession. This will make Interfor a lot less levered to a housing slowdown when compared to friends like West Fraser Timber (WFG) which have significant OSB publicity as perfectly.

- Housing shortage is a secular pressure in the US, and whilst lumber shortages are in the past, the developing cycle is even now getting slowed down by the shortages in later-stage fixtures and finishings. This suggests that the cycle has but to reset onto early-phase elements like lumber. As prices rise and housing suffers, we need to see a recommencement of lumber order exercise when the new cohort of assignments, granted a lesser cohort, commences to have to have lumber.

- If pressure will come off of goods and frees up some flatbeds, Interfor is moderately properly positioned to resume turnover to pent-up markets the place lumber has had to stay place at sawmills owing to missing logistics protection.

The Negatives

The negatives are genuinely obvious. The macroeconomic environment is likely to hurt housing starts in basic. Although the increment appears alright for Interfor as the creating cycle is stalling right before new lumber demand, housing could turn into a sore part of the financial system, and with all the leverage that goes into the housing market place from all members, like builders, that segment could drop. Though Diy accounts for rather a bit extra than housing, and pent-up demand from customers dynamics are obvious, slipping demand could get their toll on the lumber prices to which Interfor is highly leveraged.

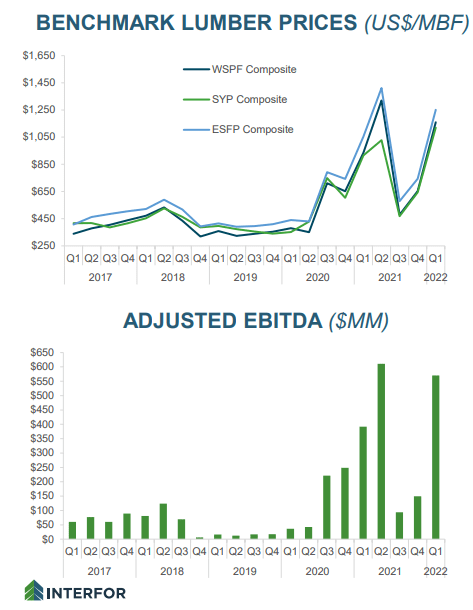

Functioning Leverage (Q1 2022 Pres)

Recent charges are 2.5x over breakeven, and would have to decline 60% in advance of Interfor commences to see losses all over again. Even though commodities answer to alterations in demand from customers and supply on the margins, 60% is a extensive even though to drop, and an LTM PE of 1.68x primarily assumes that selling prices will collapse tomorrow. On mid-cycle EBITDA forecasts, the many is likewise at only 1.7x. It is pricing falls way below 2018 ranges, and almost certainly anything closer to 2019 lumber disorders, and supplied latest rates, the operate-charge for the future 3 months of creation is probable to go over about 15-20% of EV in advance of falling off to mid-cycle amounts. This is a speculative expense, but any time period for which lumber charges keep away from collapse is a enormous revaluation opportunity. By the time the mitigants time out and lumber sinks, your expenditure will already be partly recouped in company cash balances, and then it truly is just having to pay the waiting around activity for a few of several years at most just before we see a restoration. All round, Interfor stays interesting.

If you considered our angle on this company was appealing, you could want to check out out our company, The Benefit Lab. We aim on extended-only worth strategies, the place we check out to uncover intercontinental mispriced equities and concentrate on a portfolio yield of about 4%. We’ve finished truly properly for ourselves about the last 5 many years, but it took obtaining our fingers filthy in international markets. If you are a price-investor, severe about guarding your prosperity, our group of obtain-side and sell-aspect experienced analysts will have tons to chat about. Give our no-strings-attached cost-free trial a consider to see if it truly is for you.