RichLegg/E+ by way of Getty Images

The earth is in a condition of uncertainty. No matter whether the market place has one more leg decreased or at last starts its restoration is dependent on the economic climate. Are mounting desire prices and runaway inflation likely to pull the overall economy into recession or can we definitely get that tender landing?

The following number of weeks of info will be vital in figuring out which way we are headed. On the other hand, the financial details is being neglected with the market’s undivided awareness on the Fed. Everybody would seem laser-targeted on the Fed meeting on Wednesday, June 15th. I concur that this is an crucial conference, but this kind of undivided interest typically prospects to other matters staying missed.

So, although the rest of the planet watches the Fed, I will be watching some key financial data that is coming out in excess of the same time body.

- NAHB housing market place index June 15th

- Housing starts knowledge June 16th

These influence a substantial portion of the current market right and given that housing is such a substantial portion of the economy it is a critical GDP signal. These are also quite complicated news releases with loads of diverse facts in them so allow us explore which bits are the most important and the implications they may well have throughout the marketplace vertical.

Let us get started with a dialogue of what these knowledge points are, and what ranges to count on. We will then observe with how this impacts the appropriate sectors and how I am investing to capture the opportunity.

What is this info and why is it so significant?

Housing can make up 15%-18% of GDP. That would make it amongst the biggest sectors of the economic system and the facts details that are about to come out are a gauge of the wellbeing of the housing sector.

The NAHB Housing Sector Index is a survey of a panel of builders in which they charge each of:

- Present-day sales

- Up coming 6-thirty day period income outlook

- Traffic of possible consumers

Their responses of “superior”, “good”, or “weak” are then weighted and applied to the next system as supplied by NAHB (Nationwide Association of Residence Builders).

“An index is calculated for each and every sequence by applying the formula “(good – very poor + 100)/2” or, for Site visitors, “(superior/pretty higher – reduced/really low + 100)/2″.”

In other text, if there are an equivalent volume of favorable and unfavorable responses the index will come out at 50.

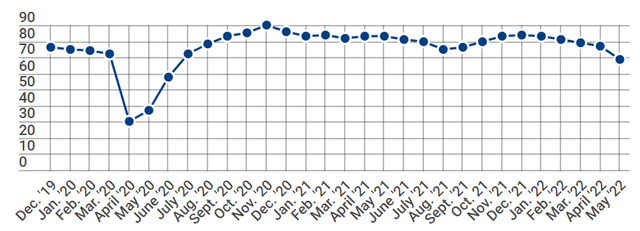

The info arrives out regular monthly and the previous couple a long time seem like this.

NAHB

The Might browse was 69, down from 77 in April. I feel the market place is anticipating more declines in the selection so something 69 or higher would be seen as a constructive when the facts is introduced.

Sentiment surveys this kind of as this a single necessarily appear with a tradeoff. The gain is that it is forward wanting whilst any factual facts is heading to be existing or backward seeking, and of training course, the draw back is that it is not goal details. It is totally doable to get a adverse browse on the sentiment since the respondents are pessimistic for other reasons these kinds of as fuel selling prices or the war, neither of which straight impact housing.

So, due to subjectivity, I think it is critical to search at the NAHB current market index in conjunction with goal details these types of as what will arrive out on Thursday, June 16th.

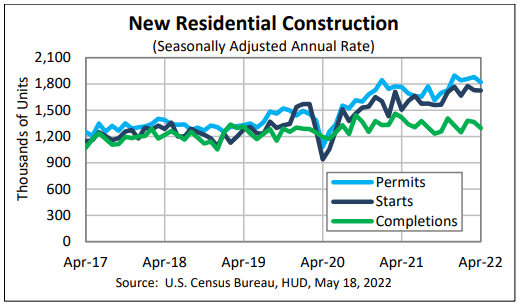

Housing starts off facts is composed of 3 parts:

- Setting up Permits

- Housing Begins

- Housing Completions

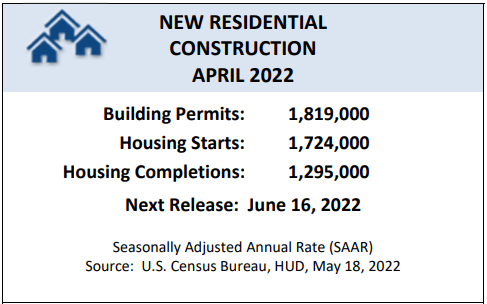

Below have been the April figures (introduced in Might):

NAHB

Frequently, the quantity of completions will approximate the number of begins, so the substantial gap above signifies a lengthening of construction timelines. The range of in-progress constructions is up due to the fact every 1 usually takes for a longer time to entire.

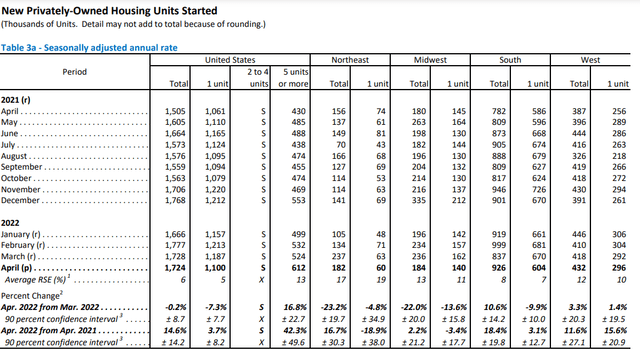

Housing starts off is inclusive of solitary-family members and multi-loved ones improvement with the breakdown tabled under.

NAHB

With home loan premiums rising, housing begins are broadly expected to slow down. There is usually a lag, even so, as the system is normally properly underway before the actual commence date. Consequently, I would foresee permitting to choose a hit temporally in advance of commences.

NAHB

Because permits have been strong, I consider starts will keep on being ordinary or much better for a bit, together with in the May perhaps data which is to be launched on Thursday. A major dip in new permits, having said that, could be witnessed as a harbinger of very low exercise likely ahead.

How I am investing in the opportunity

My investments in housing stem from the standard strategy that housing is broadly undersupplied in the United States – a strategy which I feel is quickly demonstrable. Single family members household occupancy is total by historic specifications, apartment occupancy of 97% is over what is traditionally considered entire occupancy of 95%. Folks are working with the housing units to this extent despite rates getting higher as a share of home earnings. This indicates that more households would be fashioned if housing ended up more reasonably priced.

All of this adds up to a lot more housing units becoming demanded than are now in existence. With this undersupply set up, there are only two approaches out of it.

Either builders get an incredible volume of business as they deliver provide up to velocity or the U.S. remains undersupplied and existing stock prospers.

I can’t inform which of the over will occur, but presented the existing valuations and the undersupply, I am confident that a blend of investment throughout the overall vertical will accomplish perfectly. Each portion within the vertical is in some methods a hedge for the many others so they rather shelter 1 a further, but the entire established ought to be benefitted by the broad scarcity of housing.

Below are some of the offsetting aspects which trigger these to be mutual hedges:

- Superior lumber selling prices damage builders but benefit timber REITs

- High housing starts off/permits/completions is bad for apartments but very good for builders

- Large rents as a percentage of house cash flow hurts flats but aids cost-effective housing like made housing

- Increasing property finance loan costs hurt household builders but support single household rental REITs

- Increasing home loan prices hurt Company mREITs, but assistance home finance loan servicing mREITs

Inclusive of all these groups, there are north of 70 publicly traded providers. The housing shortage has been existing given that circa 2011, a couple a long time following the Wonderful Monetary Disaster floor development to a halt. The shortage bought worse in 2020 and 2021 as COVID knocked improvement exercise underneath the sustainable amount.

Folks need someplace to stay and that is both likely to be existing real estate or recently built qualities. Not a lot of demand motorists in the economic climate are as large and as impressive as the want for housing. It is fertile ground for investment decision and tends to make up a significant chunk of my portfolio. I have absent by every sector of the vertical 1 by one particular and each firm inside of every sector and here’s my positioning from timber all the way to financing.

Timber/lumber

Four timber REITs are before long to be a few as Potlatch (PCH) purchases CatchMark (CTT). Based on each valuation and quality of functions I assume Weyerhaeuser is the greatest positioned in this sector

Homebuilders

At low to mid-solitary-digit earnings multiples, the total homebuilding sector seems low cost to me. Lennar (LEN) normally takes the cake for me on the other hand as a person can get an supplemental 16% price cut by obtaining the larger voting ability but fewer liquid (LEN.B).

Manufactured housing manufacturers

Demand for MH is unequivocally solid and seemingly on a secular basis which has held market pricing up fairly nicely. As this kind of, the valuation is not as tantalizing as other elements of the vertical, but progress tends to make some names attractive. Flagship Communities (OTCPK:FLGMF) is nicely positioned to provide middle-America and is missed by the current market due to its little dimension and Canadian listing.

Made housing neighborhood operators/owners

UMH Properties (UMH) has prolonged been in my portfolio as it receives to take part in the speedy natural and organic expansion of created housing but has historically been the only value engage in in the sector. Recently, on the other hand, industry rates have come down across the board creating Sunshine Communities (SUI) and Equity Way of living (ELS) to be GARP performs as very well.

Flats

Though housing as a complete is undersupplied, domestic migration designs strongly favor the regions of the U.S. with inflows more than all those with outflows. Sunbelt flats such as all those of Camden (CPT), BRT Flats (BRT), or NexPoint Household (NXRT) are favorably positioned as in comparison to the coastal destinations. I am watching west coastline apartment REIT Essex (ESS), even so, as its current market price tag has dipped so significantly as to make it a value REIT. This sort of a many is a historical rarity for a enterprise as very well-managed and prosperous as ESS.

Single spouse and children rental

A great deal like the manufactured housing suppliers, the energy of this sector is properly regarded which will make valuation only okay. That claimed, the business design is amazing and Tricon Residential (TCN) is on the lookout at enough expansion fees with a extended runway.

Household funding

Agency Property finance loan REITs are suffering from e-book price deterioration as better interest fees cause the industry benefit of their long-dated house loan portfolios to fall. As discount coupons get greater, the reinvestment appears to be additional favorable which will inevitably lead to better earnings. There will be a time to get into company mREITs, but I never believe it is below very yet.

Home finance loan servicers are benefitting from minimized prepayment charges as locked in low curiosity level mortgages discourage refinancing. New Residential (NRZ) is our select of the whole lot as it is having substantial book value and earnings accretion. Its preferreds appear even greater than the widespread as they have a preset to floating structure these that mounting charges immediately translate to bigger dividends for favored traders.

Back to the information unveiled on June 15th and June 16th

There is no such factor as universally very good or bad numbers in these data drops mainly because it all depends on perspective.

Homebuilders want superior begins/permits/completions and significant sentiment on the index, but apartments and SFR want the reverse. Timber REITs are mixed in that they want large commences/permits but never actually treatment about the sentiment examine.

Made housing creation is not provided in the starts determine, so they want it as reduced as attainable.

With a well balanced portfolio throughout the vertical, I am largely indifferent as to how the quantities occur in, but I will be viewing to see which sectors are fairly more powerful or weaker as a result. While these firms hedge every single other with regard to construction action and curiosity fees, they are all benefitted by the housing scarcity in The united states. Collectively, they are also element of the solution that will convey a lot more inexpensive housing options to family members.