Real estate agent Kirsten Jordan urges sellers must keep in mind it’s no for a longer time a ‘super aspirational’ market place, and to take their listings very seriously.

Approximately 600,000 residence obtain agreements fell through in June, according to a new examination by Redfin.

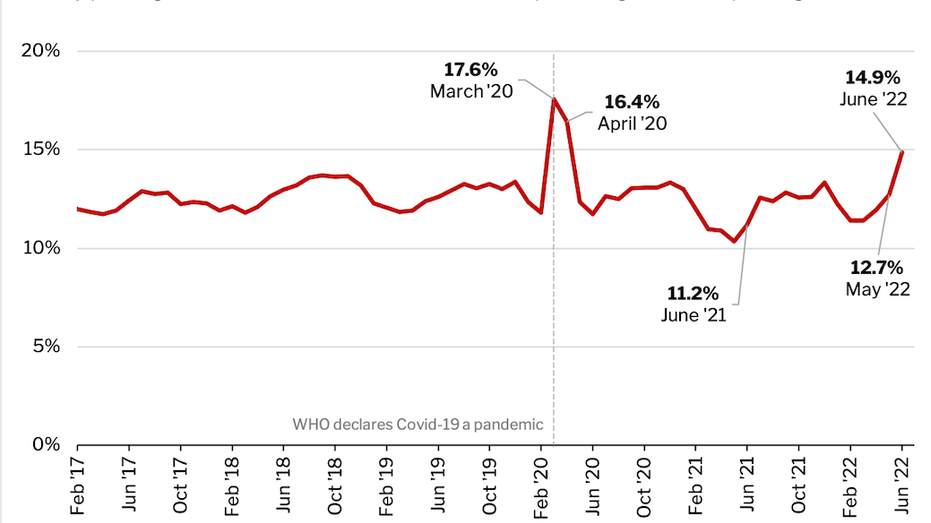

The determine is equal to 14.9% of properties that went under agreement throughout the thirty day period, an boost from 12.7% in May well and 11.2% a 12 months back.

Roughly 60,000 household obtain agreements nationwide fell as a result of in June, equal to 14.9% of properties that went underneath agreement through the month, in accordance to an analysis by Redfin. (Redfin)

June’s percentage marks the best cancellation price due to the fact March and April 2020, when the housing sector was rattled by the onset of the COVID-19 pandemic. Approximately 17.6% of households below deal in March 2020 and 16.4% of properties less than contract in April 2020 fell by means of.

FIXER-Higher Houses Price tag 45% Much less THAN Similar TURNKEY Households: Examine

Redfin deputy main economist Taylor Marr attributes June’s enhance to a slowdown in housing sector competitors, which has provided homebuyers much more room to negotiate.

“Potential buyers are increasingly maintaining fairly than waiving inspection and appraisal contingencies. That offers them the flexibility to simply call the offer off if difficulties arise all through the homebuying approach,” Marr states.

In addition, Marr said that some homebuyers are currently being priced out of their deals owing to bigger home finance loan fees. Pursuing a 75 foundation point hike by the Federal Reserve in June, the normal determination fee on a 30-calendar year fixed mortgage climbed towards 6%.

“When mortgage prices shot up to almost 6% in June, we observed a amount of consumers again out of promotions,” Lindsay Garcia, a Redfin authentic estate agent in Miami, stated. “Some had to bow out for the reason that they could no extended get a loan thanks to the leap in costs. Potential buyers are also additional skittish than usual owing to economic uncertainty.”

Homebuyers were being supplied some aid very last week when mortgage premiums fell to 5.3%, the largest a person-week fall because 2008.

GET FOX BUSINESS ON THE GO BY CLICKING Below

In addition to invest in arrangement cancellations, house builders have observed an uptick in cancellations.

According to a study by John Burns Serious Estate consulting, the countrywide cancellation rate for residence builders jumped to 14.5% in June, up from 10.4% in Might and 6.5% a calendar year ago. The determine is higher than 2018 concentrations but below the 16.5% cancellation price strike in April 2020.

| Ticker | Stability | Previous | Alter | Change % |

|---|---|---|---|---|

| LEN | LENNAR CORP. | 78.29 | -.41 | -.52% |

Lennar, which reported an 11.8% cancellation level in the next quarter of 2022, has claimed it will change its pricing centered on industry disorders and improve incentives to make up for the cooling in demand.